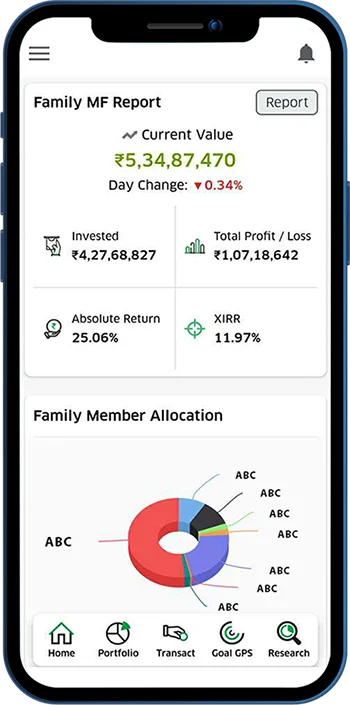

We made the investment reports very easy through Mutual fund software for distributors, all the key data you can view in a glance. We provide best financial management platform in India to advisors.

ABOUT US

Who We Are

Allegiance Financial has been in the field of wealth management and financial services for over a decade.

Founded a decade ago, our company has steadfastly stood as a beacon of trust and expertise in the financial services sector. With a comprehensive suite of offerings that include mutual funds, life and health insurance, general insurance, Portfolio Management Services, and Fixed Deposits, we have been committed to delivering excellence and value to our clients. Our journey began with a vision to demystify financial planning and investment for the average person, making it accessible and understandable. Over the years, we have expanded our services and deepened our expertise, always with the goal of empowering our clients to make informed financial decisions that align with their long-term objectives. As we celebrate ten years of service, we remain dedicated to upholding the principles of integrity, innovation, and customer-centricity that have been the cornerstone of our success.